The majority of car buyers are satisfied with their experience buying finance from dealers, according to research by JudgeService.

The research was prompted by the Financial Conduct Authority (FCA) probe into the use of discretionary commission arrangements before they were banned in January 2021 and the mis-selling campaign launched last month by Money Saving Expert, the consumer website fronted by Martin Lewis.

Money Saving Expert said it has logged 1,080,000 car finance complaint letters that have been submitted through its free car finance reclaim tool since 6 February.

“That equates to a staggering 30,000 per day. A back-of-the-envelope calculation means this could be at least £480,000,000 back for those consumers, or more, as over 25% of complaints are from people with multiple agreements,” it said on its website.

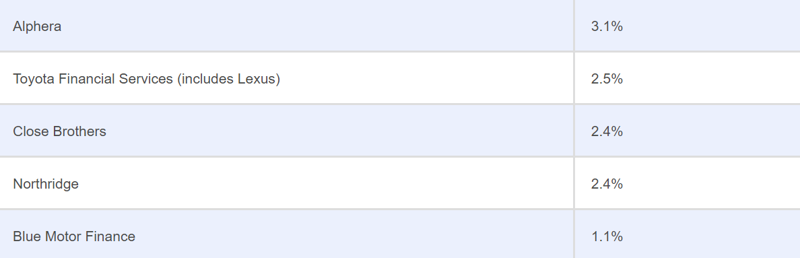

MSE added that the most complained about lenders so far included Black Horse, Volkswagen Financial Services and Stellantis Financial Services.

Data from 212,986 questionnaires completed by customers in 2020 and 2023 sheds light however on how overall satisfaction with dealer finance sales was high.

Last year 93% of buyers surveyed by JudgeService said they were satisfied with the explanation given to them by dealership sales staff of the available finance packages, up from 91% in 2020.

While satisfaction with the explanation of paperwork and documentation related to finance increased from 93.5% to 95%.

Buyers were also asked to rate their satisfaction with the attitude of sales staff during the buying process, this increased from 95.8% to 97%.

“Despite the noise generated by the FCA probe and Money Saving Expert’s compensation campaign, our research reveals the high level of customer satisfaction related to finance purchases both before and after the ban on discretionary commission arrangements,” said Neil Addley, managing director of JudgeService.

“Our dealer clients regularly access our finance satisfaction reports and receive a notification if a customer isn’t happy.

“What is being overlooked is that many car buyers are also savvy consumers, they understand that dealers earn commission on the finance they sell; they are more focused on agreeing finance deals that are fair and affordable.

“However, because of the ballyhoo around possible mis-selling, many of these customers will now be looking to be compensated for something they were satisfied with,” he said.

Breakdown of biggest lenders complained to via MoneySavingExpert’s car finance tool