The used car market has reached a major milestone, recording more than two million vehicle transactions in the first quarter of 2025 – the first time this level has been achieved since before the pandemic.

According to the latest figures released by the Society of Motor Manufacturers and Traders (SMMT), 2,020,990 used vehicles changed hands in Q1, representing a 2.7% rise compared with the same period in 2024.

The result marks nine consecutive quarters of growth, fuelled by increased availability of ex-fleet and part-exchange cars due to the recovering new car market.

Automotive Management reported in February that 2024’s total used car transactions

Petrol vehicles continued to dominate the market, with 1,149,855 units sold (up 2.1%), while diesel registrations fell by 3.1% to 679,739 units.

Internal combustion engine (ICE) vehicles still accounted for 90.5% of all used car transactions but saw their market share drop by 2.4 percentage points compared to Q1 2024 as demand for electrified models accelerated.

Battery electric vehicles (BEVs) were the standout performers, with sales soaring by 58.5% to 65,850 units, capturing a record 3.3% market share. Hybrid vehicles also saw strong demand, with 98,830 units sold (up 30.2%), while plug-in hybrid sales increased by 14.0% to 23,540 units.

“This positive performance saw the greenest powertrain continue its streak as the fastest growing, a trend which must continue to deliver the UK’s net zero goals,” SMMT said in its report.

“Long term success, however, relies heavily on healthy demand for new electric cars, making government incentives paramount. Halving VAT on new EVs and scrapping or amending their liability to the VED Expensive Car Supplement, alongside equalising VAT paid on public charging to domestic rates, would all help increase uptake of new cars and, in turn, promote a vibrant used market.”

Supermini popularity

Smaller vehicles continued to lead demand. Superminis remained the top-selling segment, accounting for 32.4% of all sales, followed by small family cars (27.0%) and dual purpose vehicles (16.8%).

These three segments collectively made up over three-quarters (76.2%) of the used car market. In contrast, sales of specialist sports, executive, upper medium and MPVs declined.

Regionally, the South East saw the highest number of transactions, with 293,103 used cars sold, followed by the North West (222,795) and West Midlands (209,154).

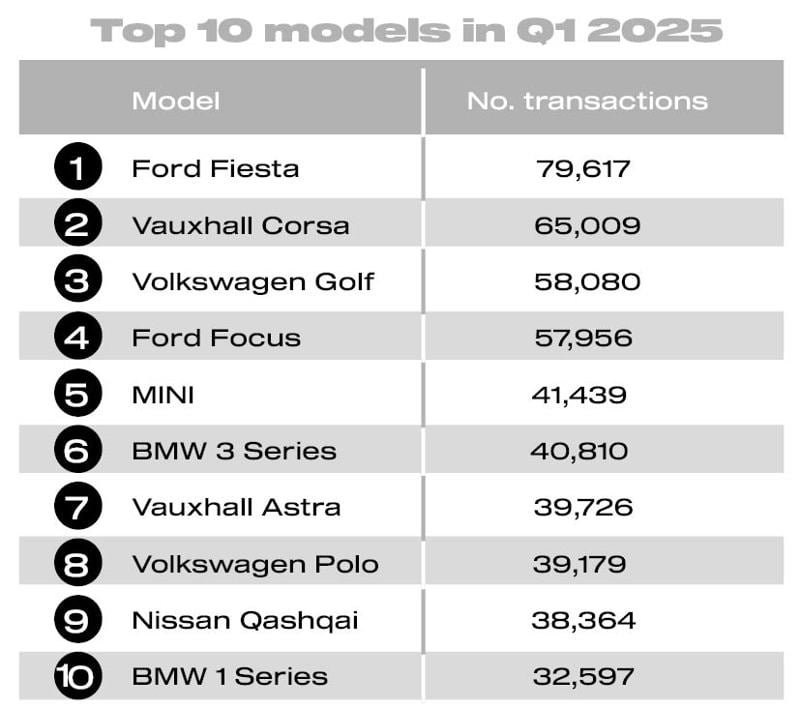

In terms of individual models, the Vauxhall Corsa led sales with 8,308 units, ahead of the Nissan Qashqai (7,462) and Volkswagen Golf (6,853). Other top-performing models included the Ford Puma, Kia Sportage, and MG HS.

Black was the most popular used car colour for the 29th consecutive quarter, representing 21.2% of all transactions. Grey and blue followed, both posting increases, while silver, orange, and gold were among the few colours to decline in popularity.

“The used car market has enjoyed its strongest start to a year since before the pandemic, with supply fuelled by a recovering new car market,” SMMT’s chief Mike Hawes said. “Critically, more second-hand buyers are opting for electric vehicles, with greater choice and affordability enabling more people and businesses to switch.”

“Sustaining and expanding this growth, however, depends on a healthy supply of EVs from the new car market – which in turn requires fiscal incentives alongside a nationally accessible and affordable charge point network so that everyone, whatever their budget or driving needs, can benefit from zero emission motoring.”

Industry comment

Commenting, James Wilson, COO of used car marketplace Motorway, said: “Whilst the new car market saw a boost in March, with buyers conscious of plate change month and the incoming Vehicle Excise Duty, consumer confidence remains under pressure. The latest used car sales figures show that drivers continue to turn to the used market for better value and greater choice.

“We’ve seen a continued increase in sales through our marketplace, and consistent demand from dealers looking to stock their forecourt. We’re seeing lower emission vehicles cement their place as the fastest-growing segment in the used market, with a 66% YoY leap in EV and hybrid sales volumes. As more second-hand EVs become available and prices continue to fall to meet demand, we’re entering a new phase where electric becomes a realistic and attractive option for more buyers.”

Ian Plummer, Auto Trader’s commercial director, added: “The used car market carried some real momentum into the new year off the back of a very strong 2024, and it’s gathered even greater pace over the last few months despite further political and economic turbulence. Retail prices are rising, cars continue to sell at record speed, and as reflected in the more than 258 million visits to our platform over the quarter, consumer demand remains very robust.

“Although the industry will face some headwinds over the coming months, I’ve no doubt the market will continue to demonstrate its huge resilience and may well already be on track to grow beyond our earlier prediction of 7.7 million sales this year.

“The quarter saw another impressive growth spurt for the maturing used electric market, as more stock, more choice, and greater affordability than ever fuelled consumer appetite. Over the last 12 months we’ve seen the volume of second-hand electric cars increase 54%, largely due to ex-lease vehicles returning to the industry. With supply only set to intensify, pressure on prices will continue, and with two in five used EVs already priced below £20,000, the second-hand market will become ever more attractive for buyers eager to make the switch.”