The Society of Motor Manufacturers and Traders (SMMT) is calling for the Expensive Car Supplement to be scrapped for pricier battery electric vehicles (BEVs) following a fourth month of decline in the new car market.

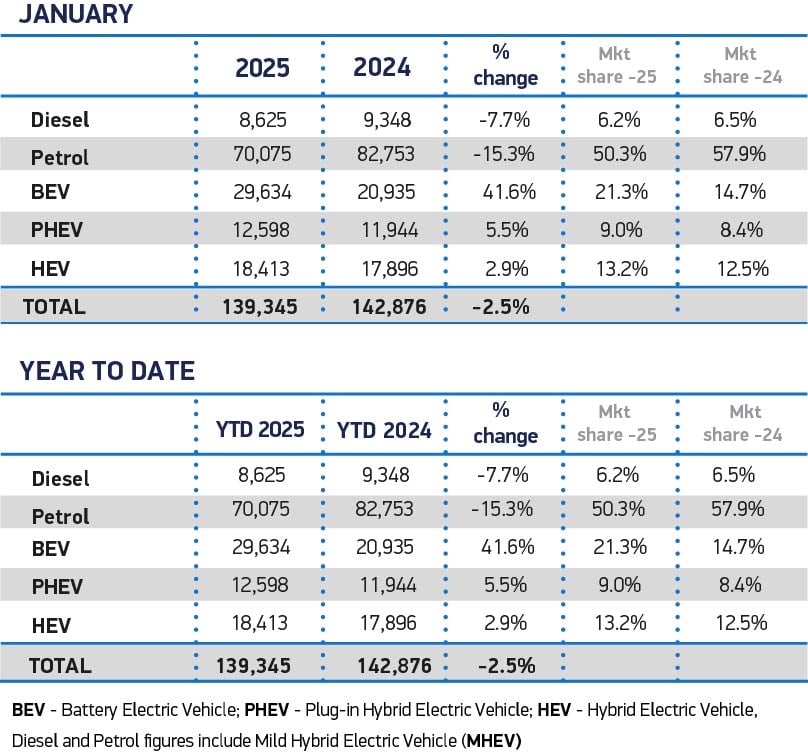

Weak consumer confidence and tough economic conditions combined to deliver a 2.5% drop in the UK’s new car market to 139,345 units in January, according to data released today by the SMMT.

The SMMT said the application of the Vehicle Excise Duty ‘Expensive Car Supplement’ (ECS) to BEVs in just two months comes “at the worst time for the industry”.

It means EV models costing more than £40,000 – which the SMMT said represents the majority on the market, given higher production costs – will incur a £3,110 tax bill over the first six years of ownership – compared with zero at present.

On a slightly more positive note, the retail market only saw a drop of 0.5% in January, while the fleet market slowed considerably with a 3.7% drop in the same month.

Business registrations rose by 2.4% although, as a very small portion of the market, this translated to just 55 additional units.

Reflecting a continuation of ongoing trends, petrol car registrations dropped by 15.3% to comprise just over half (50.3%) the market, with diesel down 7.7% to claim a 6.2% share.

Both hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs) recorded volume growth and saw their market shares rise to 13.2% and 9.0% respectively.

Battery electric vehicle (BEV) registrations, meanwhile, continued recent growth trends, with volumes up by 41.6% year-on-year to take a 21.3% market share.

Despite the good work carried out by dealer sales teams across the UK, BEV market share still remains short of the 22% target set by Government for last year, and even further behind the 28% requirement for 2025.

ZEV mandate review essential

The SMMT said the gap between demand and ambition is why the review of how the Zero Vehicle Emissions mandate and the trading scheme put in place for car brands that don’t meet targets is “essential and must deliver meaningful changes urgently, else there will likely be significant negative consequences for the market, industry and, potentially, the consumer”.

The trade body said private retail buyers still lack a meaningful fiscal incentive to buy an EV and, moreover, the application of the Vehicle Excise Duty ‘Expensive Car Supplement’ (ECS) to BEVs in just two months comes at the worst time for the industry.

It said the change will impact both the new and used car markets, “undermining the goal of a mass market transition”.

As a result, the industry is calling for tax plans to be revised to ensure the system is fair and avoids dissuading those who want to buy an EV.

Mike Hawes, SMMT chief executive, said: “January’s figures show EV demand is growing – but not fast enough to deliver on current ambitions.

Mike Hawes, SMMT chief executive, said: “January’s figures show EV demand is growing – but not fast enough to deliver on current ambitions.

“Affordability remains a major barrier to uptake, hence the need for compelling measures to boost demand, and not just from manufacturers.

“The application, therefore, of the ‘Expensive Car Supplement’ to VED on electric vehicles is the wrong measure at the wrong time.

“Rather than penalising EV buyers, we should be taking every step to encourage more drivers to make the switch, helping meet government, industry and societal climate change goals.”

The SMMT said the the threshold for the ECS – dubbed the ‘luxury car tax’ when launched – has remained unchanged at £40,000 since it was set eight years ago, when the overall market was 30% larger than today and BEVs barely featured.

EVs should be exempt from ECS

Hawes wants to at least see the price threshold for the ECS raised, or would prefer for EVs to be exempted from the ECS entirely.

He said: “With more than twice as many BEVs registered this January than in the whole of 2017, raising the eligibility threshold for EVs – or exempting them from the ECS entirely – would send the message that EVs are essentials, not luxuries, and ensure vehicle taxation remains fair and appropriate for today’s market conditions.”

The latest market outlook anticipates the new car market declining slightly in 2025 by 0.2% to 1.95 million units, with BEV uptake rising by 20.9% to 462,000 – a 23.7% market share, but still short of the mandated 28% target for the year.

The gap is anticipated to widen in 2026, when BEVs are expected to comprise 28.3% against a target of 33%. The growing disparity between market demand and regulated targets further underscores the need for substantive market incentives that match ambition.

UK dealers have a pessimistic outlook for 2025

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA) said the organisation’s 2025 Outlook Survey shows dealers are concerned with the outlook for 2025, with 71% selecting ‘pessimistic’ in response to how they view the overall trading environment for the year ahead, while 29% were ‘slightly optimistic.’

Robinson said: “Also in the survey, dealers highlighted the need for Government support, including incentives such as grants and investments in charging infrastructure.

“They also stressed the continued benefits of hybrids beyond 2030.

“These will be highlighted in NFDA’s response to the phase-out date/ZEV mandate consultation this month.”

Robinson said this year is expected to bring notable changes for automotive dealers, including an increase in Employers’ National Insurance contributions from 13.8% to 15% and the introduction of VED on EVs.

She added: “The UK automotive sector is a vital sector in the UK and historically NFDA members have been very flexible and resilient to headwinds.”

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, said that without clearer industry support, a fully electric future risks stalling on the road.

He said: “Deloitte research shows a strong majority (80%) of UK consumers who intend to purchase an electric vehicle plan to charge their vehicle at home, compared to other options such as public charging stations (10%) or at work (11%).

“While convenient for some, this highlights a significant barrier to EV adoption for those without a driveway.

“A robust and reliable public charging network is essential to give all drivers the confidence to make the switch.”

The Government’s reported plans to introduce subsidies for EV consumer loans could provide a much-needed boost to the private market.

Hamilton said: “Making EVs more financially accessible is crucial to driving mass adoption and achieving net zero ambitions.

“However, this must be part of a broader strategy that provides manufacturers clarity on 2030 Zero Emission Vehicle targets and addresses the needs of all drivers, including investment in public charging infrastructure.”