The UK’s new car market edged back into growth last month, with registrations up 1.6% year on year in May to 150,070 units – the strongest May performance since 2021, according to figures from the Society of Motor Manufacturers and Traders (SMMT).

The uplift was led by fleets and business buyers, whose registrations grew 3.7% and 14.4% respectively, making up nearly two-thirds (62.6%) of the market.

Private demand, however, continued to soften, falling by -2.3% for the second consecutive month – a reflection of ongoing cost-of-living pressures and fragile consumer confidence.

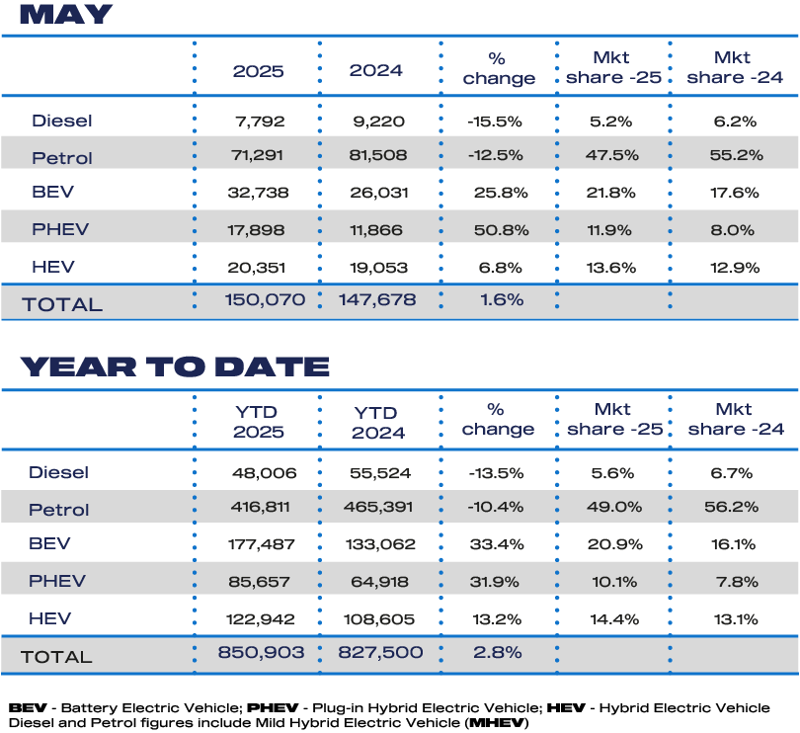

Battery electric vehicle (BEV) registrations rose sharply by 25.8%, taking a 21.8% market share as manufacturers turned to significant discounting and strong incentives to stimulate demand.

Sales of plug-in hybrids (PHEVs) soared 50.8%, while hybrids (HEVs) were up 6.8%. Petrol and diesel registrations, by contrast, dropped -12.5% and -15.5% respectively.

While growth in electrified vehicles is promising, BEV market share year-to-date remains at just 20.9% – well short of the 28% required under the government’s Zero Emission Vehicle (ZEV) Mandate.

“A return to growth for new car registrations in May is welcome,” said Mike Hawes, SMMT chief executive. “But manufacturer discounting on new products continues to underpin the market, notably for electric vehicles.

“This cannot be sustained indefinitely as it undermines the ability of companies to invest in new product development – investments which are integral to the decarbonisation of all road transport.”

The SMMT is urging government to introduce targeted fiscal incentives in the upcoming Spending Review to support electric vehicle uptake. The industry body says halving VAT on new EV purchases could deliver 267,000 additional electric cars over three years, cutting CO₂ emissions by six million tonnes annually.

It also recommends removing EVs from the Vehicle Excise Duty (VED) Expensive Car Supplement and aligning VAT on public charging with the lower rate levied on home charging.

“Next week’s Spending Review is the opportunity for government to double down on its commitments to Net Zero,” added Hawes, “by driving demand through fiscal measures that boost the market and shore up our competitiveness.”

The number of available BEV models continues to expand, now exceeding 135 – up from 106 a year ago – alongside over 100 PHEVs and nearly 50 HEVs. The average BEV now delivers a range close to 300 miles on a single charge.

Some plug-in hybrids can now cover up to 88 miles in electric-only mode, while HEVs offer electric drive at low speeds with zero tailpipe emissions.

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), said, “The impact of pressures such as Employers’ National Insurance, the extension of Vehicle Exercise Duty and the Expensive Car Supplement to electric vehicles will be closely monitored moving forward as well as the uncertainty regarding the blocking/unblocking of US tariffs.

“Looking ahead, we are likely to see pressure on the new vehicle market, due to weak economic growth.

“We expect electric vehicles sales to continue to increase, however they still remain someway off the ZEV Mandate targets for 2025. Over many years franchised dealers have proven their resilience and this current period of economic turbulence is no difference.

“NFDA is looking ahead to the Government’s Spending Review next week and it provides a prime opportunity to clarify its objectives to reach the ZEV Mandate and wider net zero targets.”