The UK car market is expected to hit its peak in terms of petrol vehicle numbers in 2024 although the industry continues to grapple with the -pandemic shortage of nearly 3 million cars not sold during that period, stricter Zero Emission Vehicle (ZEV) targets, rising competition from new brands and models – all at a time of lacklustre appetite for electric vehicles (EV).

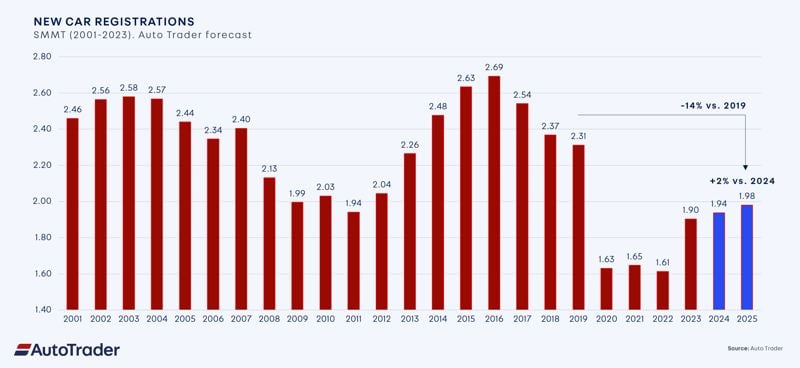

According to Auto Trader’s 2025 forecast, the new car market is projected to grow for a fourth consecutive year, reaching around 1.98 million registrations in 2025, up 2% from the 1.94 million expected in 2024.

Despite this growth, the market remains 14% below the pre-pandemic peak of 2.31 million registrations recorded in 2019.

Several challenges are shaping the industry. Stricter Zero Emission Vehicle (ZEV) targets are exerting pressure, with a required EV market share of 22% in 2024 and 28% in 2025. However, EV adoption is lagging behind these benchmarks, with EVs predicted to account for only 18% of the market in 2024.

Private new car sales are also declining significantly, expected to hit 740,000 registrations in 2024 – a 27% drop compared to 2019 and the lowest level in over two decades. Rising costs are further complicating matters, as the average price of a new car has climbed from £31,000 in 2019 to £43,020.

Auto Trader notes that competition is intensifying, with 17 additional brands and 81 new models introduced since 2019 and that the average buyer researches 17 brands, reflecting an appetite for alternatives.

To address this, manufacturers are adopting a “conquest-led” strategy focused on attracting new customers while leveraging data-driven marketing to maintain brand loyalty and meet ZEV targets.

Discounts have risen to 9% as of October 2024, compared to 7.4% a year earlier, reflecting a partial return to pre-pandemic “push” sales tactics.

The EV market, while growing, is underperforming regulatory expectations, however. By 2025, Auto Trader estimates that the EV market share is predicted to rise to 23%, but this still falls short of the 28% ZEV mandate.

As a consequence, it says manufacturers will need to ramp up efforts to convert traditional petrol and diesel customers to EVs, with targeted marketing and consumer incentives crucial to driving adoption and compliance.

In contrast, the used car market remains a bright spot, showing strong resilience amidst broader economic challenges. Sales are expected to grow from an estimated 7.61 million in 2024 to 7.70 million in 2025, putting the market within 3% of pre-pandemic levels.

While the new car market faces significant headwinds, the resilience of the used car market provides a counterbalance, offering some stability amid the ongoing transformation.

The affordability gap created by rising new car prices, coupled with enduring demand, has bolstered the used car sector, which continues to perform strongly.

Commenting on the forecast, Auto Trader’s commercial director Ian Plummer said: “It’s been another landmark year for automotive retailing, one that’s included a range of challenges, not least the introduction of ZEV targets, constrained supply, changing finance rules, and the Budget, but also exceptionally strong used car demand, record levels of engagement on our platform, rapid speed of sale, and the stabilising of retail prices. And with the more attractively priced and available stock in recent months helping to fuel new car interest, the overall retail market is entering 2025 on a strong footing.”

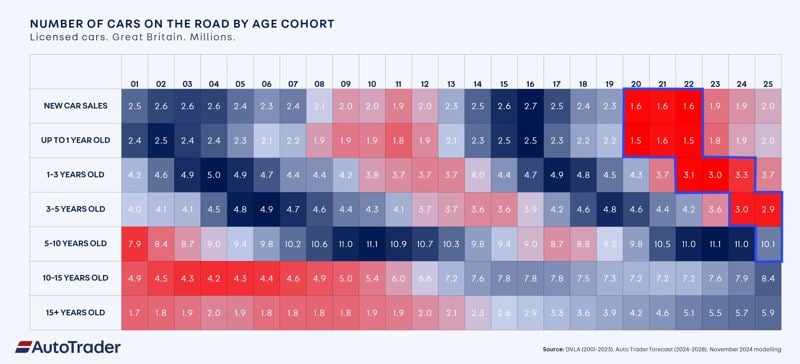

Auto Trader said the challenges facing the car market remain deeply influenced by the aftershocks of the pandemic, particularly in the used car sector. The effects of 3 million unsold new cars during the pandemic continue to ripple through the vehicle parc, shifting the availability of used cars across age segments.

This year, the number of 3-5-year-old cars in the parc has dropped by 37% compared to 2019, falling from 4.8 million to 3 million. By the end of 2025, this figure is expected to decline further to 2.9 million – the lowest level on record.

As these vehicles age, their scarcity will begin to affect the 5-10-year-old segment, exacerbating sourcing challenges for dealers.

The dynamics of fuel type within the parc are also shifting significantly. 2024 is projected to be the peak year for petrol cars in the UK parc, with their numbers starting to decline from 2025 as the adoption of electric vehicles (EVs) accelerates.

EVs are set to comprise 1.66 million vehicles in the parc next year, a 33% increase from the 1.25 million in 2024, equating to a 5% share. This trend is reflected on platforms like Auto Trader, where EV stock rose 32% year-on-year in October, while petrol stock dropped by 7%, marking seven consecutive months of decline.

By 2027, there will be nearly 1 million fewer petrol cars in the parc compared to today. Despite this, demand for petrol cars is expected to remain robust, driving up prices and intensifying competition for stock.

Consequently, having a well-defined strategy for used EVs will become increasingly important. As the supply of EVs grows and petrol vehicles diminish, understanding these trends will be crucial for dealers aiming to meet shifting consumer preferences and maintain profitability.

Plummer concluded: “2025 is set for growth, but this year’s complexities will remain, and in some cases, tighten, particularly within the new car market, where a rapidly growing array of brands will be competing for the attention of an increasingly fickle new EV buyer.

“Brands and retailers alike cannot afford to standstill and will need to adopt a conquest mindset next year, as well as focusing on what they can excel at – delivering great product, a great experience, and a great performance, all of which we’ll continue to support through our technology, data and our investments.”