Chinese competition is outpacing Tesla’s previous electric vehicle market dominance across Europe, according to the latest data from JATO Dynamics.

In February, Chinese owned car brands registered 19,800 new electric vehicles in Europe, outpacing Tesla which registered just over 15,700 units.

In the same month last year, the former registered 23,182 units compared to the 28,131 registered by Tesla.

Tesla’s market share fell to 9.6% – the lowest it has been during the month of February over the last five years.

The brand’s year-to date market share fell from 18.4% in 2024 to 7.7% this year

Felipe Munoz, global analyst at JATO Dynamics, said Tesla’s volume drop is most likely due to the continued impact of customers waiting for the new Model Y.

However, he said Tesla chief executive Elon Musk’s increasingly active role in politics may also be playing a factor, but this will only truly be revealed when the new Model Y is on sale in the market.

Tesla experience period of immense change

He said: “Tesla is experiencing a period of immense change.

“In addition to Elon Musk’s increasingly active role in politics and the increased competition it is facing within the EV market, the brand is phasing out the existing version the Model Y – its best-selling vehicle – in anticipation of the introduction of a new refreshed version.

“During this process, brands often experience a drop in sales before they return to normal levels, once the updated model becomes widely available.”

Munoz said brands like Tesla, which have a relatively limited model lineup, are particularly vulnerable to registration declines when undertaking a model changeover.

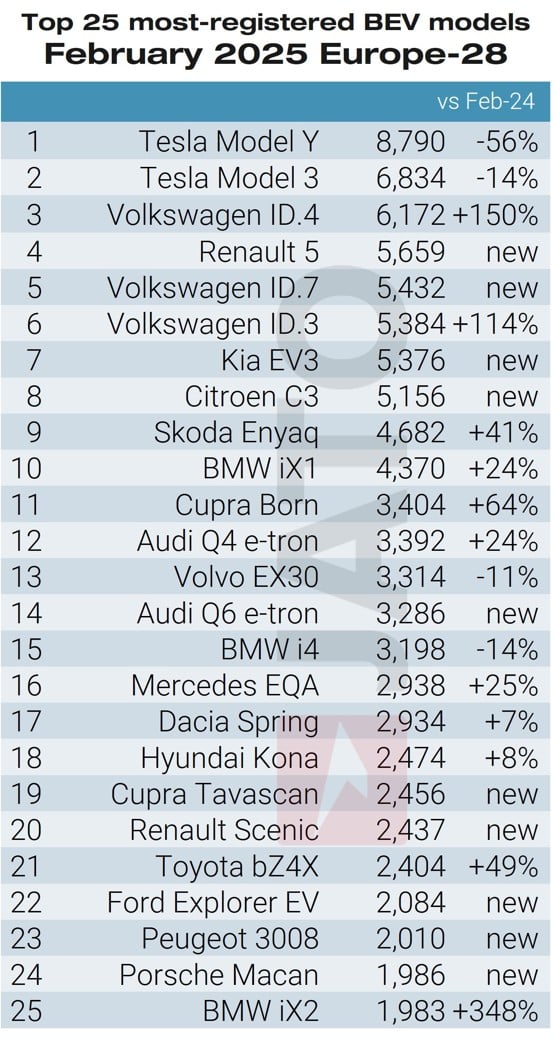

In February, registrations of the Model Y fell by 56% to 8,800 units, while registrations of the Model 3 fell by 14% to 6,800 units.

Total European market down 3% in February, but EVs see spike in growth

A total of 966,300 new passenger cars were registered in Europe last month, marking a decline of 3% compared to the corresponding month last year.

Decreases in Germany, Italy, Belgium, the Netherlands, Switzerland and Ireland were the main drivers for the downward trend.

Year-to date registrations fell by 2% to a total of 1,962,850 units.

Munoz said: “There are still no clear signs of recovery in the European automotive industry.

“Uncertainty in the domestic market is being further complicated by challenges in both China and the US.”

Last month, registrations of battery electric vehicles (BEVs) increased by 26% to 164,000 units.

This is the highest volume on record for both the month of February and the period of January to February, during which 329,700 units were registered, up by 31%.

Renault Group top performer in February

Volkswagen group continued to lead the market with a share of 25.8%.

Stellantis followed in second position but lost 2.6 points of share when compared to February 2024 due to double-digit drops at Citroen, Opel/Vauxhall and Fiat.

Renault Group was the month’s top performer, with a 12% increase in volumes and a market share gain of 1.5 points.

The group’s strong performance in February can be attributed to positive results posted by the Renault Clio, Dacia Duster and the new Renault Symbioz and Renault 5.

Much of Renault’s success was found in the BEV segment, with 9,400 BEVs registered in February, up by 96%.

The French manufacturer was only outperformed by Volkswagen,which recorded a 108% increase in BEV sales.

Other strong increases within the BEV segment include Audi (+67%), Kia (+56%), Skoda (+63%), Citroen (+190%), Cupra (+179%), Mini (+804%), and Ford (+146%).

In contrast, Tesla, Volvo, MG, Fiat, Jeep and Smart all recorded declines.

The Sandero leads again

The Dacia Sandero once again led in the ranking by model as Europe’s most registered new vehicle during the month.

Meanwhile, second position was occupied by the Citroen C3,with the new generation already being widely available.

The Renault Clio followed closely in third thanks to a 22% increase in volumes – the second best within the top 10, only outperformed by the Volkswagen Tiguan, ninth position, which recorded a 43% increase in registrations.