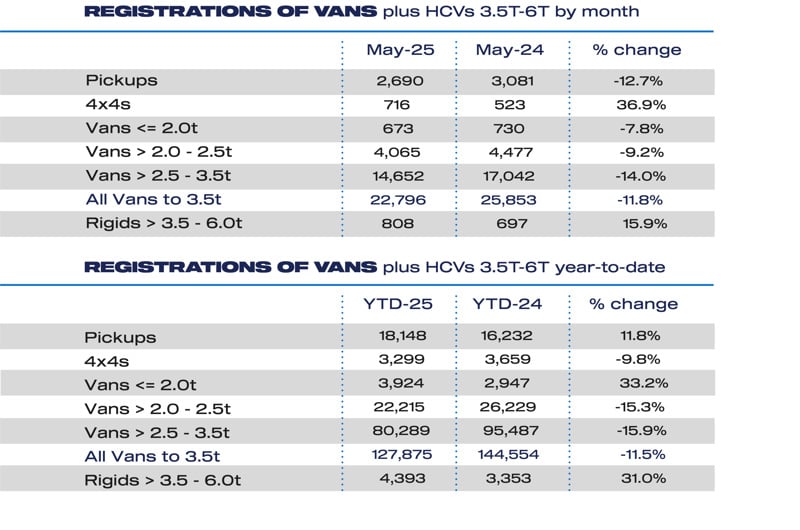

The light commercial vehicle (LCV) market shrank by -11.8% in May, with 22,796 vans, 4x4s and pick-ups registered, according to new data from the Society of Motor Manufacturers and Traders (SMMT).

This marks the sixth consecutive monthly decline and the weakest May performance since 2022, as low business confidence continues to suppress fleet renewal.

Demand fell across nearly all segments. Large van registrations dropped -14.0%, medium vans were down -9.2%, and small vans declined by -7.8%. Pickup registrations also slid by -12.7%, following the introduction in April of new tax rules that treat double-cabs as cars for benefit-in-kind and capital allowance purposes.

The change is already having an impact on critical sectors like construction, farming and utilities, while the only area of growth came from the new 4×4 segment, which rose by 36.9%.

The SMMT is warning that the tax changes risk keeping older vehicles on the road for longer while also reducing government revenue due to falling sales. The organisation is calling for the reforms to be postponed by at least a year, giving the market more time to adapt as more low- and zero-emission models become available.

BEV van growth

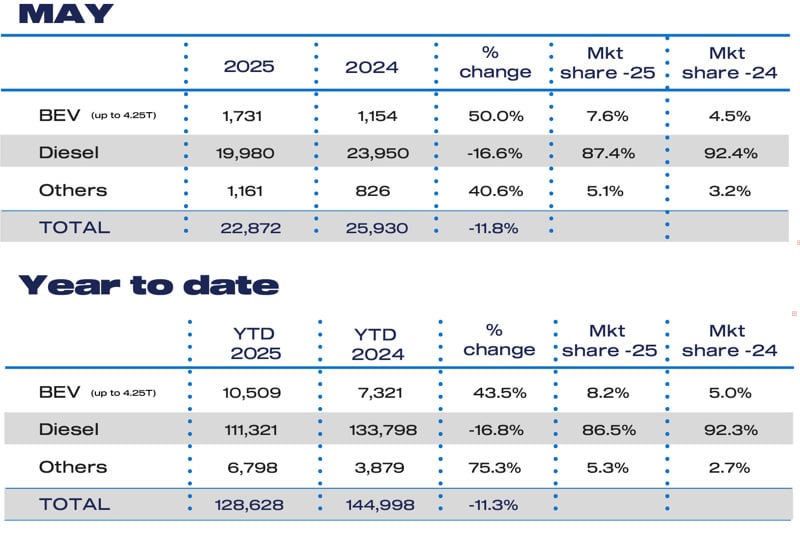

Despite the broader downturn, battery electric vans (BEVs) continued their upward trend, with registrations rising by 50.0% to 1,731 units in May.

This is the seventh consecutive month of growth, reflecting manufacturers’ investment in electrification and a growing range of BEV models on offer.

However, electric vans still made up just 7.6% of the total market in May and 8.2% year to date – half the 16% share mandated by the Zero Emission Vehicle Mandate for 2025.

The SMMT said that while the Plug-in Van Grant remains crucial, the pace of charging infrastructure investment must increase significantly to support the transition.

Public, depot and shared hub charging solutions need to be developed at scale, with preferential treatment for depot grid connections – currently subject to wait times of up to 15 years – seen as vital. Streamlined planning policies at the local level will also be key to giving businesses the confidence to switch to electric fleets.

Mike Hawes, SMMT chief executive, said: “Six months of declining new van demand reflects a tough economic environment and weak business confidence – and that won’t be helped by punitive taxes such as on double-cabs that will only restrict wider growth.

“Fleet renewal with the latest, cleanest models must be encouraged so it’s positive that zero emission van uptake is rising, but with market share at just half the mandated level, it’s clear we need action to drive that uptake faster. Accelerating LCV-centric and affordable chargepoint rollout is the bold next step that van operators and manufacturers need now.”

NFDA concern

“May’s figures mark another month of lower-than-expected light commercial vehicle registrations, reflecting continued pressure on the market” said Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers.

“The slowdown across traditional van segments is concerning, particularly in the 2.5-3.5t category, which continues to represent the largest share of the UK’s LCV market.

“The recent Benefit-in-Kind tax changes have also had an immediate impact on the pick-up segment, which saw a 12.7% fall in registrations.

“On a positive note, electric van registrations continue to rise, with a 53.7% year-on-year increase. However, with BEVs accounting for just 8.2% of the market – well below the mandated target – this highlights ongoing concerns among buyers around the practicalities of operating electric LCVs.”