A diminishing 0-3-year vehicle parc, the proliferation of less complicated electric vehicles (EVs), and motorists keeping their vehicles longer continue to impact the franchised sector’s workshops. While the sector now performs better for both younger vehicles (0-4 years) and vehicles aged 5-9 compared with a decade ago, according to Quentin Le Hetet, country director at aftermarket intelligence business GiPA UK, the opportunity for retention is reduced as a direct result of fewer vehicles in the car parc.

Le Hetet (pictured) says: “Real gains can be made in vehicles aged 10+, but this is a tricky segment to target because owners are price-sensitive and not easily swayed by the prospect of OEM parts or trained technicians working on their vehicles.

“0-4 years will become the sweet spot for franchised dealers, but they need to excel here and be at the very top of their game.”

The used car market could prove lucrative for aftersales, while dealers should also improve service plan sales. GiPA’s survey of 3,000 motorists, published in May, found that among drivers without a service plan, 11% would be interested in one. This rises to 23% among franchised customers. Meanwhile, only 20% of customers are offered a courtesy car or collection and delivery service, yet around 30%-35% of customers would like that level of service.

The experience of Pete Walker, Hendy Group director of bodyshop and service, is different. One brand covered the cost of courtesy vehicles as a pilot, yet the group struggled to achieve the five-a-day target. Using customer feedback to drive strategy, Hendy Group has received more than 87,000 customer comments in the past 12 months, revealing that interaction with the service advisor is among the most valued aspects of the aftersales experience.

As the take-up of less complicated EVs increases and consumers gain more flexibility in their working lives, Hendy expects to undertake more while-you-wait services with reduced content. Walker says: “Many independents don’t want to service EVs because it is so specialised, and many will disappear as more EVs come onto the roads. We expect the content of the service will reduce, and retention will increase.”

This will put pressure on infrastructure in terms of technician numbers and valeters – Hendy envisions 60% more visits with less content. Communication is key for Hendy, with video footage of their vehicle directly from the technician being crucial for building trust. Its online booking system links directly with workshop diaries, ensuring customers know their booked slot is secured.

Around 15% of customers use Hendy’s online booking tool, a figure the group aims to increase. The group also offers 0% finance to cover repair bills, but fewer than 1% of customers take advantage of this option.

At the point of sale and post-sale, AutoProtect identifies opportunities to offer services such as extended warranties, paint protection, tire and glass repair, home charging infrastructure, and more. Mike Edwards, chief sales and marketing officer, says: “Sustaining aftersales will require reimagining the traditional operating model by looking again at existing, underutilised products and services, creating new ones, and challenging established practices.

“We see real opportunities to promote ‘in-journey’ services by leveraging customer data alongside the inherent face-to-face trusted personal service experience that a franchised dealer provides.”

“We see real opportunities to promote ‘in-journey’ services by leveraging customer data alongside the inherent face-to-face trusted personal service experience that a franchised dealer provides.”

UK dealers can remain optimistic, as the franchised sector has retained market share, unlike many other major European markets. Measured in terms of the number of repair and maintenance operations, the UK has gradually increased its share to 27% in 2023, according to the ICDP.

ICDP managing director Steve Young says: “Reasons behind this, in our view, are the generally more professional management of UK dealer groups, who have done a better job of addressing older cars and gearing up to compete on tires, for example (aided by the much more efficient wholesale tire distribution system in the UK).”

Efficiency remains a priority, and Tjekvik’s digital check-in and check-out solutions have been rapidly adopted by UK dealers, helping alleviate aftersales queues. Currently, 55% of customers check in their vehicles from home, and 26% of these continue their digital journey using Tjekvik’s dealer-based check-in.

JCB Crawley pre-calls customers the day before their booking to encourage home check-in, which has contributed to a 10%-15% increase, with as many as 80%-85% of customers checking in from home on some occasions. Tjekvik has also launched an outdoor kiosk for check-in and check-out, available 24 hours a day, seven days a week.

Customers are presented with additional products and services during the digital process, such as season-specific offers, air conditioning checks, service plans, and extended warranty packages. This approach taps into the 72% of customers who want to know about relevant add-on products and services, according to Tjekvik’s survey of 1,000 UK franchised customers. In the first half of 2024, customers globally interacting with Tjekvik technology purchased more than 141,000 value-added items, generating over £7 million in additional revenue.

This feature is from AM’s Spotlight On The Customer report.

Read the full report here.

Utilising the SecretService platform has enabled dealer groups, including Marshall Motor Group, Hartwell, Eden, Pendragon, Vertu, and Waylands, to compete on a like-for-like basis with the independent sector when targeting older vehicles.

Head of SecretService, Paul Jordan, says: “We attract motorists who have fallen out of the franchised network as their vehicle has aged, were used car customers, or were shopping around.”

Customers acquired via SecretService result in, on average, 13% higher final invoice values than workshops would normally achieve from regular customers, as vehicles are older. The current sweet spot is vehicles registered in 2018. Of new customers driven in from the 4-to-10-year-old vehicle parc, 35.22% were 4-6 years old, 35.02% were 7-9 years old, and 29.76% were 10 years or older.

Attracting customers who purchased older vehicles not originally from the dealership is where SecretService excels – 92% of bookings are from customers not previously seen by the dealership. Jordan says: “Franchised dealers often think it is excessively expensive to win conquest business and focus on lapsed customers, but they are fishing in a diminishing pool. We have proved that it is possible to attract conquest customers cost-effectively.”

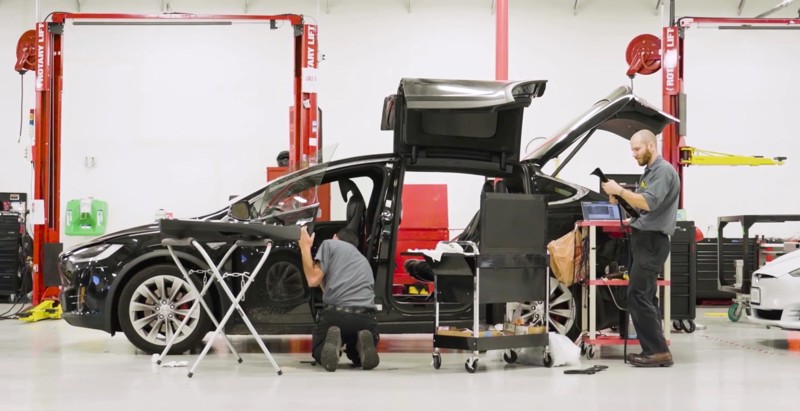

One of the biggest challenges facing the sector is its workforce. Vehicle technicians, mechanics, and electricians make up 14.9% of the total automotive workforce, according to the Institute of the Motor Industry (IMI). However, 20.3% are aged 55+ and may soon require replacement.

Over the past decade, jobs in maintenance and repair have grown by 16%, and the sector has the highest vacancy rate in the UK at 3.8% as of July 2024. This translates to 21,000 vacancies, compared with the national average vacancy rate of 2.7%. Vacancy rates for roles such as vehicle technicians, mechanics, and electricians made up 51% of job openings in July 2024 (IMI Vacancy Rate Tracker). Consequently, advertised salaries for technicians have increased by 9% over the past two years, but wage hikes alone may not be enough to overcome the skills gap.

The IMI predicts that by 2035, the sector will need 150,000 EV-certified technicians to meet demand, indicating a potential skills gap of 20,500 technicians. ADAS-certified technicians represent just 2% of the UK technician workforce, yet 13% of UK cars already feature some Level 2 autonomy, a figure projected to rise to 50% by 2032.

The IMI predicts that by 2035, the sector will need 150,000 EV-certified technicians to meet demand, indicating a potential skills gap of 20,500 technicians. ADAS-certified technicians represent just 2% of the UK technician workforce, yet 13% of UK cars already feature some Level 2 autonomy, a figure projected to rise to 50% by 2032.

The demand for ADAS skills is expected to soar, with 156,000 ADAS-trained technicians needed by 2032 (IMI Automotive Education Report Edition 11). The IMI predicts these challenges will lead to longer wait times, higher costs, reduced access to specialised technicians, and potential declines in service quality, particularly for owners of advanced vehicles such as EVs and those equipped with ADAS.

The sector must address these issues urgently.